Money advice usually arrives as a loud, generic broadcast. Save more. Spend less. Invest for tomorrow. The commands are simple, but they never seem to plug into the messy reality of your bills, your debts, your particular hopes. The gap between that general shouting and your specific life can feel impossibly wide.

Now imagine a money guide that only spoke to you. A handful of new platforms are building exactly this. They work like a personal trainer who designs every rep and every set around your current fitness level and your personal finish line. They meet you where you stand today.

This changes everything. You stop following orders and start building understanding. You learn how your money can work for the life you already have.

Your Personal Finance Guides: Platform Comparison at a Glance

| Platform | Best For | Personalization Style | Cost Model | Unique Angle |

| Finelo | The structured learner who wants a custom curriculum | Adaptive learning paths and a simulated environment | Subscription-based | A step-by-step financial “coach” that builds your knowledge from the ground up |

| Asksia | The curious learner with specific, immediate questions | On-demand AI tutoring; you guide your own learning | Free | An AI tutor that provides instant, conversational answers to any finance question |

| LinkedIn Learning | The professional linking career growth to financial health | Curated paths for career-related financial goals | Subscription (often via employer) | Integrates personal finance lessons directly with professional development and salary growth |

| Cube Wealth | The goal-oriented individual ready to execute a plan | Goal-based planning with human coach access | Combines technology with paid coaching services | A hybrid platform that turns learning into action with a tailored financial plan and expert guidance |

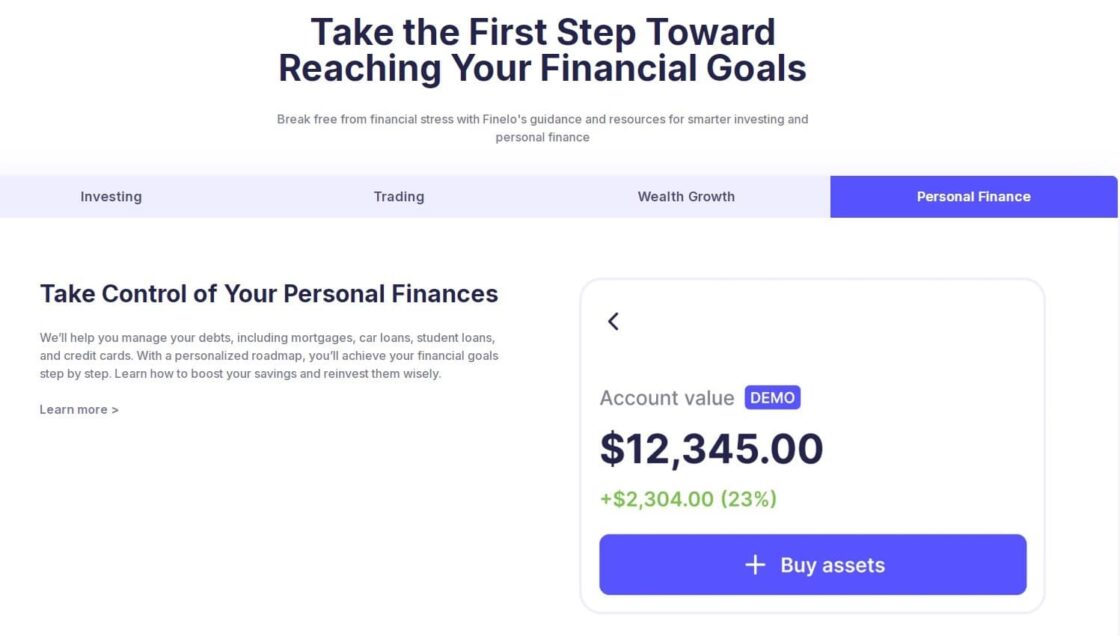

Finelo: Your Adaptive Finance Coach

Finelo.com works like a GPS for your financial life. You put in your start point and your end goal. The app then plots a unique course just for you, adjusting the turns if you take a wrong one.

How personalization works: The platform begins with a simple quiz to gauge your knowledge and goals. Your answers shape a custom learning path. The app then serves you bite-sized lessons that match your level. If you struggle with a concept like compound interest, it offers alternative explanations and examples until it clicks. Your dashboard becomes a unique reflection of your financial learning journey.

What you’ll master: You will walk through the big money topics one by one. Making a budget for the first time. Untangling your debt. Getting your head around investing. The material zeroes in on your weak spots. Every small lesson builds a little more confidence for the next.

Finelo runs on a subscription. You are paying for a learning path that walks with you through the whole money maze. It makes a scary topic feel like something you can handle.

Asksia: Your AI Finance Tutor

Asksia gives you a brainy friend who knows everything about money. This friend is always awake. You learn by tossing it any question that pops into your head.

How it fits to you: Just type what you want to know. “Can I buy a house while I still have student loans?” or “What does the stock market even do?” The AI reads your words and talks back in plain English. Your learning journey is just a string of your own curious questions.

What you’ll master: You gain clarity on the specific financial issues that confuse or worry you. It’s perfect for filling knowledge gaps as they arise in your daily life, from tax questions to deciphering financial news. You build understanding one personalized answer at a time.

Asksia provides a free AI tutoring service. It’s an incredible tool for on-demand, specific explanations, acting as a supplement to more structured learning or for when you need an immediate, clear answer.

LinkedIn Learning: Your Career-Integrated Money Guide

LinkedIn Learning stands out by connecting your financial health directly to your professional growth. Its “Keys to Success in Personal Finance” path is built for working adults who need to see the direct link between their career and their wallet.

How personalization works: It’s not a custom-built road, but it knows your neighborhood. The service bundles lessons for work life. It suggests stuff for handling a big raise, budgeting with a freelancer’s unpredictable pay, or retirement planning as you age in your job. It ties the lessons to your professional profile.

What you’ll master: You learn to manage money around your work. This covers talking about your salary, handling freelance taxes, and saving for retirement as your career moves forward. Everything you learn applies directly to your life as someone who earns a paycheck.

LinkedIn Learning needs a subscription, which your company might pay for. It’s a strong pick if you want to tie your job growth and your financial growth together.

Cube Wealth: Your Goal-Oriented Financial Hub

Cube Wealth, as highlighted in the provided insights, takes a goal-based planning approach. It’s less about abstract lessons and more about applying financial principles to your specific, stated objectives.

How it fits to you: The app makes you name your targets. A safety net fund. A down payment for a home. Your retirement. Your whole screen and the coach’s advice then focus on hitting those exact marks. The system and its people help you build a personal plan and put your money moves on autopilot.

What you’ll master: You figure out how to run a money plan built for your biggest dreams. The focus is on doing: automating your savings, picking the right investments for each goal, and shielding what you own with the proper insurance.

Cube Wealth mixes tech with human coaches. It’s a hands-on setup for people tired of just reading and ready to start doing, with a guide built for their own personal finish line.

Conclusion: Finding Your Financial Confidence

The days of piecing together money tips from random blogs are done. The new method fits itself to your world. It responds to your moves.

Your pick comes down to how your brain works. Need a guide that builds everything around your starting line? Finelo lays that track. Learn best by chasing answers to your own questions? Asksia waits for your call. Is your paycheck the center of your money story? LinkedIn Learning weaves the two together. Ready to stop learning and start building toward a big goal? Cube Wealth brings the blueprint and the coach.

The trick isn’t hunting for more tips. It’s about matching your mind to the right method. These services show that the best way to get good with money isn’t a public race. It’s a private walk on a path cut just for your feet. Pick your first step. Then watch your savings and your nerve get a little stronger each week.